All Categories

Featured

Table of Contents

That commonly makes them a much more economical option forever insurance coverage. Some term policies might not keep the premium and death benefit the same in time. You don't intend to incorrectly think you're getting degree term coverage and afterwards have your survivor benefit adjustment later on. Lots of people obtain life insurance policy coverage to help monetarily shield their enjoyed ones in situation of their unforeseen death.

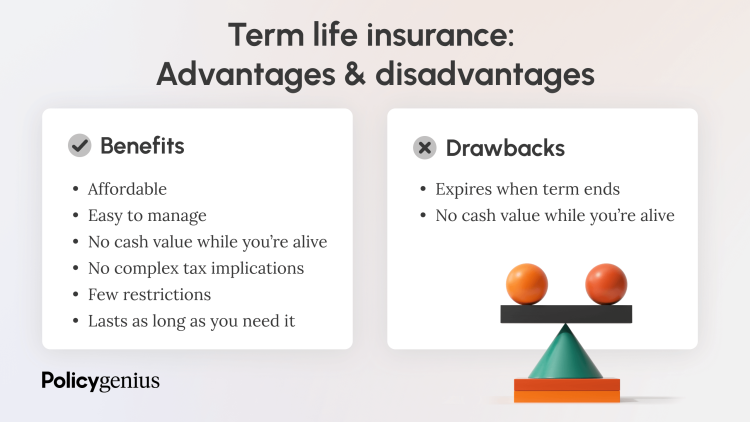

Or you may have the option to transform your existing term protection into an irreversible policy that lasts the remainder of your life. Numerous life insurance plans have prospective benefits and drawbacks, so it's vital to comprehend each prior to you determine to buy a policy.

As long as you pay the premium, your recipients will certainly obtain the survivor benefit if you die while covered. That claimed, it is very important to note that the majority of policies are contestable for 2 years which indicates protection might be retracted on fatality, must a misrepresentation be discovered in the application. Policies that are not contestable frequently have a rated survivor benefit.

Costs are generally less than whole life plans. With a level term policy, you can pick your protection quantity and the plan size. You're not secured right into a contract for the remainder of your life. Throughout your policy, you never have to stress over the premium or fatality benefit amounts altering.

And you can not pay out your plan throughout its term, so you will not receive any economic take advantage of your past protection. Just like other sorts of life insurance coverage, the cost of a level term policy depends on your age, coverage needs, work, way of life and wellness. Typically, you'll locate much more economical coverage if you're more youthful, healthier and much less risky to guarantee.

Dependable What Is Voluntary Term Life Insurance

Given that degree term premiums stay the same for the period of insurance coverage, you'll recognize exactly just how much you'll pay each time. Level term protection also has some versatility, allowing you to tailor your policy with additional features.

You may have to satisfy certain problems and qualifications for your insurance firm to pass this motorcyclist. There also can be an age or time limitation on the coverage.

The survivor benefit is typically smaller sized, and protection generally lasts until your youngster transforms 18 or 25. This cyclist may be a more cost-effective means to help guarantee your youngsters are covered as bikers can usually cover several dependents simultaneously. As soon as your kid ages out of this coverage, it might be feasible to transform the cyclist right into a new plan.

The most typical type of irreversible life insurance is whole life insurance, yet it has some vital differences compared to degree term insurance coverage. Right here's a fundamental introduction of what to think about when comparing term vs.

Guaranteed Issue Term Life Insurance

Whole life insurance lasts for life, while term coverage lasts insurance coverage a specific periodParticular The premiums for term life insurance policy are normally reduced than entire life insurance coverage.

One of the main attributes of level term insurance coverage is that your costs and your fatality advantage do not transform. With reducing term life insurance policy, your costs stay the same; nevertheless, the death advantage amount obtains smaller gradually. You may have insurance coverage that starts with a fatality benefit of $10,000, which could cover a mortgage, and after that each year, the fatality advantage will certainly decrease by a set amount or percentage.

Due to this, it's typically a much more cost effective kind of degree term insurance coverage., however it may not be enough life insurance policy for your needs.

After determining on a policy, finish the application. For the underwriting process, you may have to supply general individual, wellness, lifestyle and employment information. Your insurance provider will establish if you are insurable and the risk you might provide to them, which is mirrored in your premium expenses. If you're approved, authorize the documentation and pay your very first costs.

Cost-Effective Voluntary Term Life Insurance

Finally, consider organizing time each year to evaluate your policy. You may desire to upgrade your recipient info if you have actually had any type of considerable life modifications, such as a marital relationship, birth or divorce. Life insurance policy can sometimes really feel complicated. Yet you don't need to go it alone. As you explore your alternatives, take into consideration discussing your needs, wants and worries about an economic specialist.

No, level term life insurance policy doesn't have cash money value. Some life insurance policy plans have an investment function that permits you to construct cash money value over time. A section of your costs settlements is alloted and can make interest over time, which grows tax-deferred throughout the life of your coverage.

You have some alternatives if you still desire some life insurance policy coverage. You can: If you're 65 and your protection has run out, for instance, you may want to get a brand-new 10-year degree term life insurance policy.

Family Protection What Is Voluntary Term Life Insurance

You might have the ability to convert your term coverage right into an entire life policy that will last for the rest of your life. Lots of kinds of level term policies are convertible. That indicates, at the end of your protection, you can convert some or every one of your plan to entire life coverage.

Degree term life insurance policy is a plan that lasts a collection term generally between 10 and three decades and includes a level death benefit and degree costs that stay the same for the whole time the plan holds. This suggests you'll know exactly just how much your repayments are and when you'll need to make them, permitting you to spending plan as necessary.

Level term can be a great option if you're seeking to purchase life insurance policy coverage for the very first time. According to LIMRA's 2023 Insurance policy Measure Research, 30% of all adults in the U.S. need life insurance and do not have any kind of plan. Level term life is foreseeable and cost effective, which makes it one of the most popular kinds of life insurance coverage.

Latest Posts

Burial Expenses Insurance

Best Funeral Insurance For Seniors

Marketing Final Expense Insurance