All Categories

Featured

Table of Contents

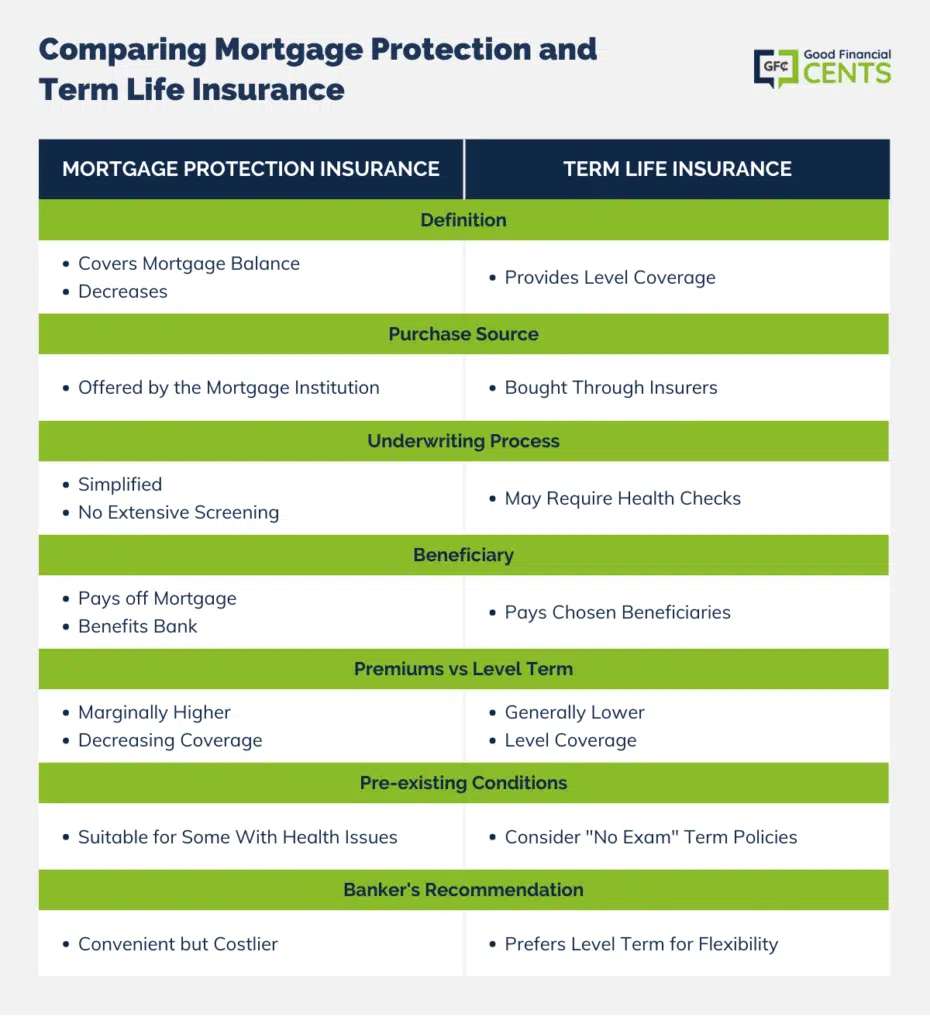

Home loan life insurance policy provides near-universal insurance coverage with minimal underwriting. There is frequently no medical checkup or blood example called for and can be a valuable insurance plan choice for any type of home owner with significant pre-existing clinical conditions which, would certainly avoid them from acquiring conventional life insurance coverage. Other advantages consist of: With a mortgage life insurance policy plan in place, successors will not need to worry or question what might take place to the family home.

With the home loan paid off, the family will constantly belong to live, provided they can afford the property tax obligations and insurance coverage each year. home buyers protection insurance reviews.

There are a few various kinds of home loan security insurance, these include:: as you pay even more off your mortgage, the amount that the plan covers reduces according to the exceptional balance of your home mortgage. It is the most common and the least expensive type of home mortgage protection - average cost of life insurance for mortgage.: the quantity guaranteed and the premium you pay stays degree

This will settle the mortgage and any type of remaining equilibrium will go to your estate.: if you want to, you can include major ailment cover to your home loan protection policy. This suggests your home mortgage will be cleared not only if you die, but likewise if you are identified with a significant illness that is covered by your plan.

Mortgage Life Insurance No Medical Exam

Additionally, if there is a balance remaining after the mortgage is cleared, this will go to your estate. If you change your mortgage, there are a number of points to take into consideration, depending upon whether you are topping up or expanding your home loan, changing, or paying the home mortgage off early. If you are topping up your home loan, you need to ensure that your policy fulfills the brand-new worth of your home mortgage.

Contrast the costs and benefits of both options (mortgage life and disability insurance calculator). It may be more affordable to keep your original home loan security policy and then purchase a second plan for the top-up quantity. Whether you are topping up your home mortgage or extending the term and require to obtain a brand-new policy, you may discover that your premium is greater than the last time you obtained cover

How Much Is Mortgage Protection Insurance Calculator

When switching your home mortgage, you can assign your mortgage defense to the brand-new lending institution. The premium and degree of cover will certainly be the exact same as before if the quantity you obtain, and the term of your home mortgage does not transform. If you have a policy with your lending institution's team plan, your lending institution will certainly cancel the policy when you switch your home loan.

In California, mortgage protection insurance covers the whole impressive balance of your financing. The fatality advantage is an amount equivalent to the equilibrium of your home mortgage at the time of your death.

Life Insurance Or Mortgage Protection

It's important to comprehend that the fatality advantage is offered directly to your lender, not your enjoyed ones. This assures that the continuing to be financial obligation is paid in full which your loved ones are saved the financial pressure. Home loan security insurance policy can additionally provide temporary insurance coverage if you end up being handicapped for an extensive period (generally 6 months to a year).

There are numerous advantages to obtaining a home mortgage protection insurance plan in California. A few of the leading benefits consist of: Assured approval: Even if you're in inadequate health and wellness or operate in an unsafe profession, there is guaranteed approval with no medical examinations or laboratory examinations. The same isn't real for life insurance policy.

Handicap security: As specified above, some MPI plans make a couple of home mortgage settlements if you end up being handicapped and can not generate the very same earnings you were accustomed to. It is essential to keep in mind that MPI, PMI, and MIP are all different kinds of insurance policy. Home loan protection insurance (MPI) is created to repay a home mortgage in case of your fatality.

Home Mortgage Insurance

You can even apply online in mins and have your policy in area within the exact same day. To learn more regarding obtaining MPI insurance coverage for your mortgage, get in touch with Pronto Insurance today! Our well-informed agents are here to address any kind of concerns you may have and provide additional assistance.

MPI offers several benefits, such as peace of mind and simplified certification processes. The death advantage is directly paid to the loan provider, which restricts versatility - mpi auto insurance calculator. Additionally, the benefit amount reduces over time, and MPI can be a lot more pricey than basic term life insurance policy plans.

Mortgage Insurance That Pays Upon Death

Go into basic details concerning yourself and your home loan, and we'll compare rates from various insurers. We'll additionally reveal you exactly how much coverage you require to shield your mortgage.

The major benefit right here is clearness and self-confidence in your decision, understanding you have a plan that fits your demands. As soon as you accept the strategy, we'll take care of all the paperwork and configuration, making sure a smooth execution procedure. The favorable outcome is the comfort that features recognizing your household is safeguarded and your home is safe and secure, whatever happens.

Specialist Recommendations: Support from knowledgeable experts in insurance policy and annuities. Hassle-Free Arrangement: We manage all the paperwork and implementation. Economical Solutions: Locating the best protection at the most affordable feasible cost.: MPI particularly covers your mortgage, offering an added layer of protection.: We function to discover the most affordable remedies customized to your budget plan.

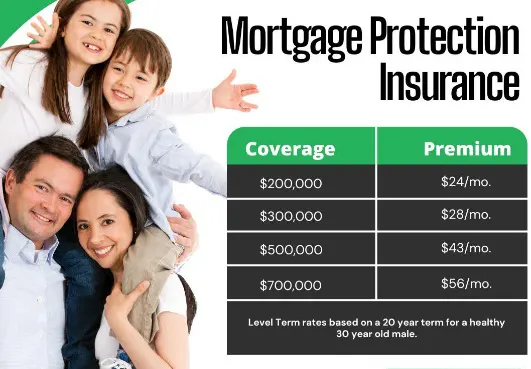

They can offer details on the coverage and advantages that you have. Usually, a healthy and balanced person can expect to pay around $50 to $100 per month for mortgage life insurance coverage. It's advised to get an individualized home mortgage life insurance quote to obtain an accurate price quote based on private circumstances.

Latest Posts

Burial Expenses Insurance

Best Funeral Insurance For Seniors

Marketing Final Expense Insurance